housing allowance for pastors 2021

At the end of the year the church treasurer issues Pastor T a W-2 that reports taxable income of 30000 salary less housing allowance. With some denominations retirement plans a minister must first ask to have a percentage of their distributions declared as housing prior to being able to receive the tax break.

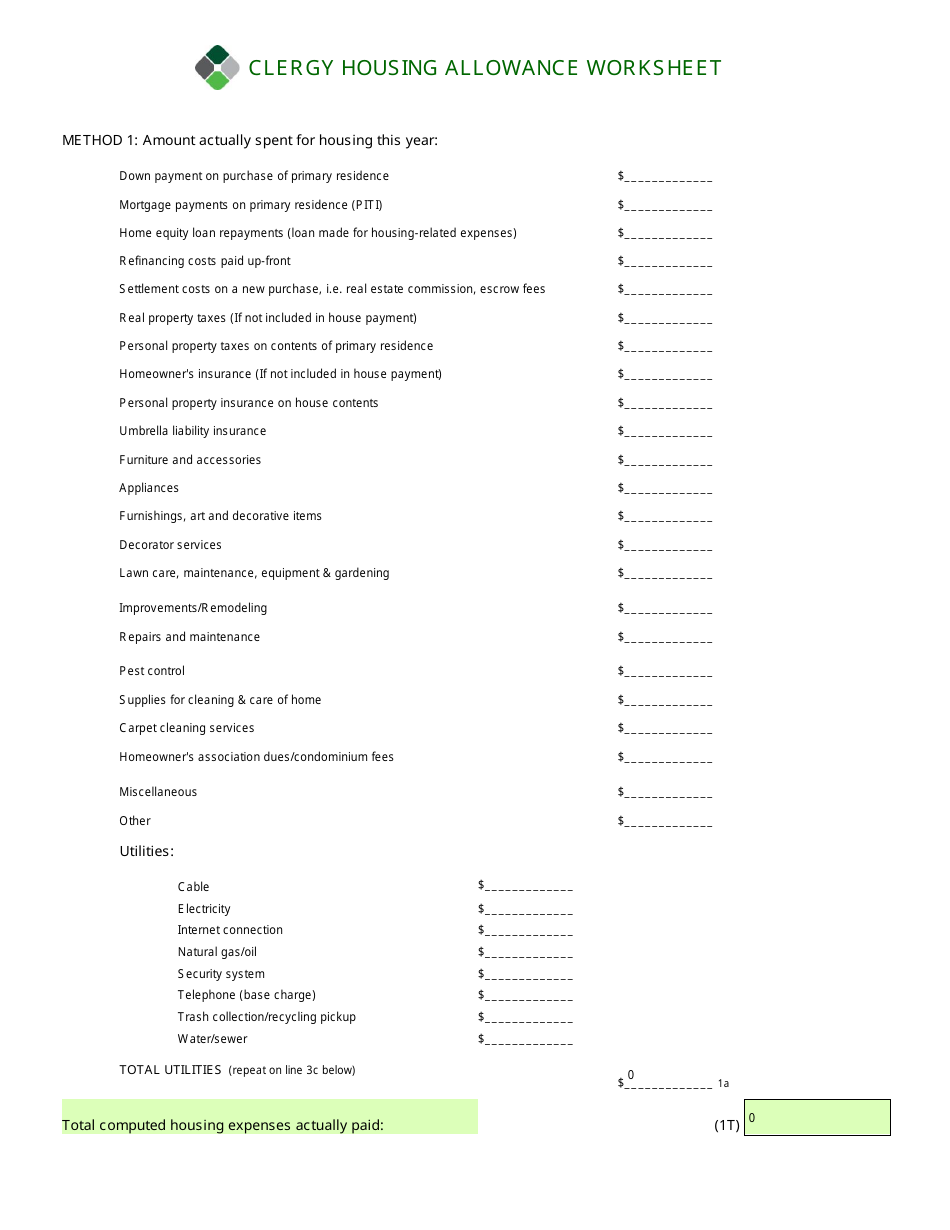

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller

When understood and implemented fully this can be a lifelong tax advantage for all ministers.

. The IRS lists only food and servants as prohibitions to allowance housing expenses. However AGFinancial automatically designates 100 of a ministers MBA 403 b distributions as housing. Taxes without housing allowance.

This payment was 1400per person. Housing allowance based on local market conditions benefits including pension insurance. For less than fulltime pastors housing is a component of compensation to be negotiated between the pastor the church and the District Superintendent.

Housing Manse Parsonage Designation. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount. It designated 20000 of this amount as a housing allowance.

It is then up to the minister to determine and report the. However to determine how much. If it is have your church fix it and send you an amended Form W-2.

If you find that the lowest number is your designated housing allowance that. As a result taxable income is understated on his W-2 by 3000. The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization.

For 2021 the cost for CRSP to the church is 105 of pension plan compensation and. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes. Amy March 4 2022.

They must pay Social SecurityMedicare tax on the entire compensation of 65000. Whereas ministers who own or rent their home do. 20000 in that box.

Salary of 50000 Taxed on 50000 12 6000 Owed income tax of 6000. Social Security Coverage The services you perform in the exercise of your ministry are generally covered by social security and Medicare under the self-employment tax system regardless of your status. Church boards can use the language below to create a resolution for a pastor who owns or rents a home.

Clergy minister or missionary wages reported on Form W-2 are subject to self-employment taxes but no Social Security and Medicare taxes are withheld. Taxes without housing allowance. The housing allowance should never be included with wages in Box 1.

In this illustration there is a 3360 tax savings with the Housing Allowance. Money from an IRA cannot count as a housing allowance but money from a church pension or 403b can. The church can report the pastors housing allowance by writing something like Housing.

Taxes with housing allowance. However Pastor T only has 17000 of housing expenses in 2021. An amount that represents reasonable pay for your.

Salary of 50000 tax rate for 2021 is 12 for Married Filing Jointly and total housing expenses of 28000 rentmortgage insurance taxes utilities furnishings etc. Churchescharges providing a housing allowance in lieu of a parsonage should follow the Conference. Local housing can be the greatest variable in costs from region to region within the CAC.

If it is included on Form W-2 then it has been reported to the IRS. If your mortgage payment is 2000 a month but you could only rent the home for 1500 then your housing allowance is limited to 1500 a month. The fair rental value of a parsonage or the housing.

The following resolution was duly adopted by the board of directors of Name of Church at a regularly scheduled meeting held on Day Month Year a quorum being present. Housing Allowance covers pastors out-of-pocket expenses incurred in the church-provided home. Generally the housing allowance is reported in Box 14 of the W-2 and is not included in Boxes 1 3 or 5.

Box 14 would simply say something like Housing. Keep this notice as your tax preparer will want to see it when your 2021. February 16 2021.

But if your church has only designated 1450 a month for your housing allowance then thats the most you can claim. Retired pastors can claim a housing allowance but only from a church retirement plan. Salary of 50000 tax rate for 2021 is 12 for Married Filing Jointly and total housing expenses of 28000 rentmortgage insurance taxes utilities furnishings etc.

You will need this information to fill out Schedule SE and pay your SECA taxes. Your church will report to. Should you receive more than you can justify the excess should be considered taxable.

However Pastor T only has 17000 of housing expenses in 2021. The housing allowance for pastors is limited to the least of. The amount officially designated in advance of payment as a housing allowance.

In 2021 the third stimulus payment was mailed to taxpayers. If a clergys annual compensation is 65000 and their church has designated a housing allowance of 15000 they subtract that from their salary bringing their taxable income for federal income tax purposes to 50000. This is of particular concern in high housing cost areas.

The amount actually used to provide or rent a home. A housing allowance is also available to a minister living in a parsonage to the extent he uses the allowance for his personally paid out-of-pocket costs not paid by the church. Unfortunately theres still a.

A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes. The IRS will mail Notice 1444-C to let you know the amount you received. 2020-2021 CLERGY MINIMUM COMPENSATION GUIDELINES.

The fair market rental value of the home including furnishings utilities garage etc. But did end up moving by the end of 2021. The IRS tax code allows ministers to designate part of their compensation as Housing Allowance.

30 of the pastors cash salary. If a minister owns a home the amount excluded from the ministers gross income as a housing allowance is limited to the. The minister must include the amount of the fair rental value of a parsonage or the housing allowance for social security coverage purposes.

Four Important Things To Know About Pastor S Housing Allowance Churchstaffing

Designating A Housing Allowance For 2021

2020 Housing Allowance For Pastors What You Need To Know The Pastor S Wallet

Pastoral Housing Allowance For 2021 Pca Rbi

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazon Com Books

Retirement Benefits And Housing Allowance For Ministers Of The Gospel Wels Bpo

Video Q A Changing Your Minister S Housing Allowance The Pastor S Wallet

10 Housing Allowance Tips For Ministers What Ministers And Churches Need To Know Housing Allowance Irs Taxes Allowance

What Is A Minister S Housing Allowance Who Qualifies

Clergy Housing Allowance Worksheet 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

Top 5 Faqs Regarding Minister S Housing Allowance Baptist21

2020 Housing Allowance For Pastors What You Need To Know The Pastor S Wallet

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

How Much Housing Allowance Can A Pastor Claim The Pastor S Wallet

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller Housing Allowance Clergy Allowance